Financial insights that unlock low-cost credit for online brands

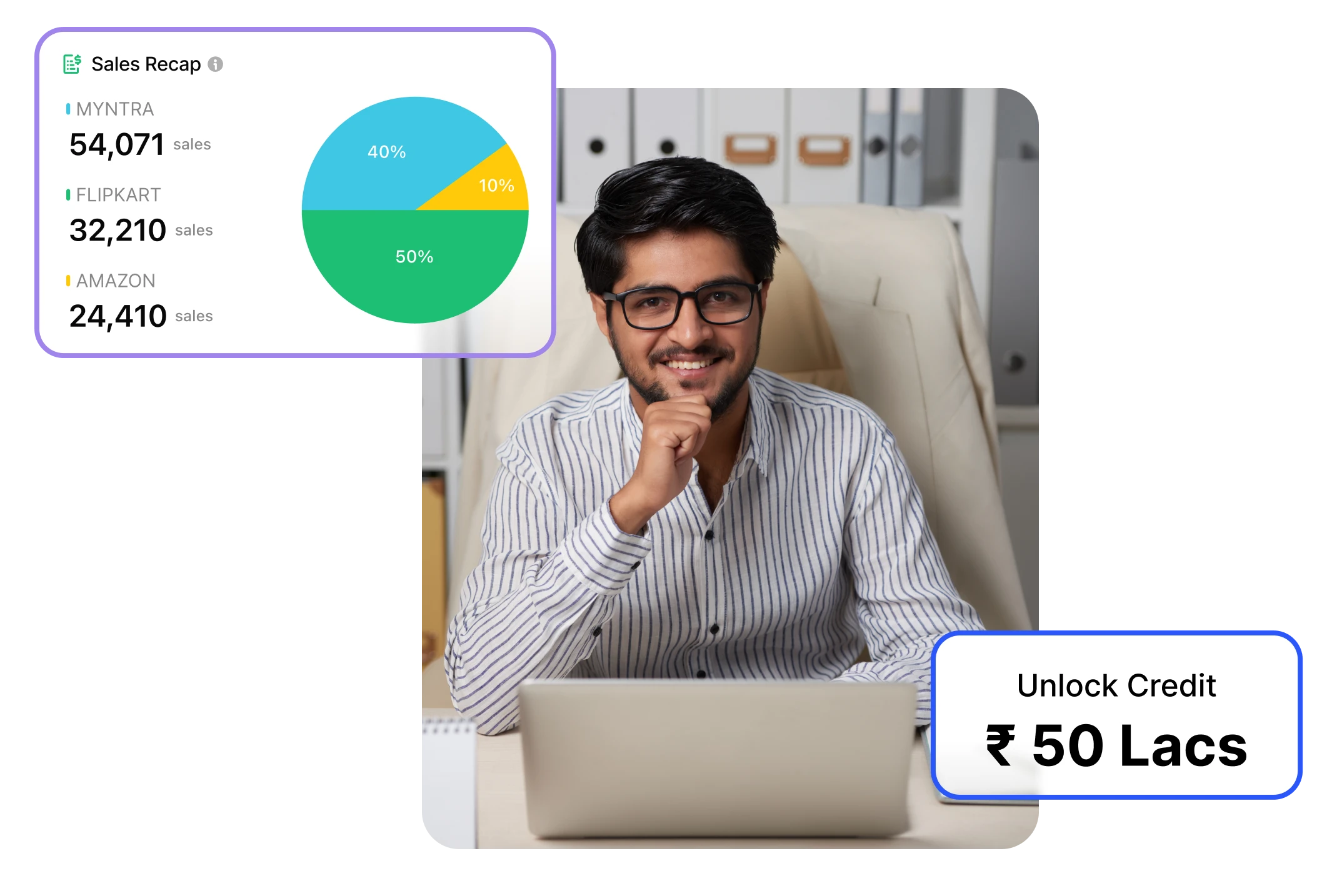

Get free financial reports, track your business health, and access tailored financing options—all from one platform. Built for transparency, powered by data.

Trusted by the best digital businesses

Trusted by the best digital businesses

Boost Lending Decisions with Our Data Insights

Lenders reduce risk through unique, enriched data from multiple sources along with lead generation

Become a Partner

Merchants access affordable credit, diverse options, detailed financial reports, and transparent products on one platform.

Get Started

We make it easy for Lenders & Businesses

For Lenders

Enhanced Risk Assessment

Leverage enriched non-banking transactional data to reduce risk & underwrite more effectively.

Expand your lending Opportunities

Access new prospects & increase loan sizes by gaining a 360° view of customer performance.

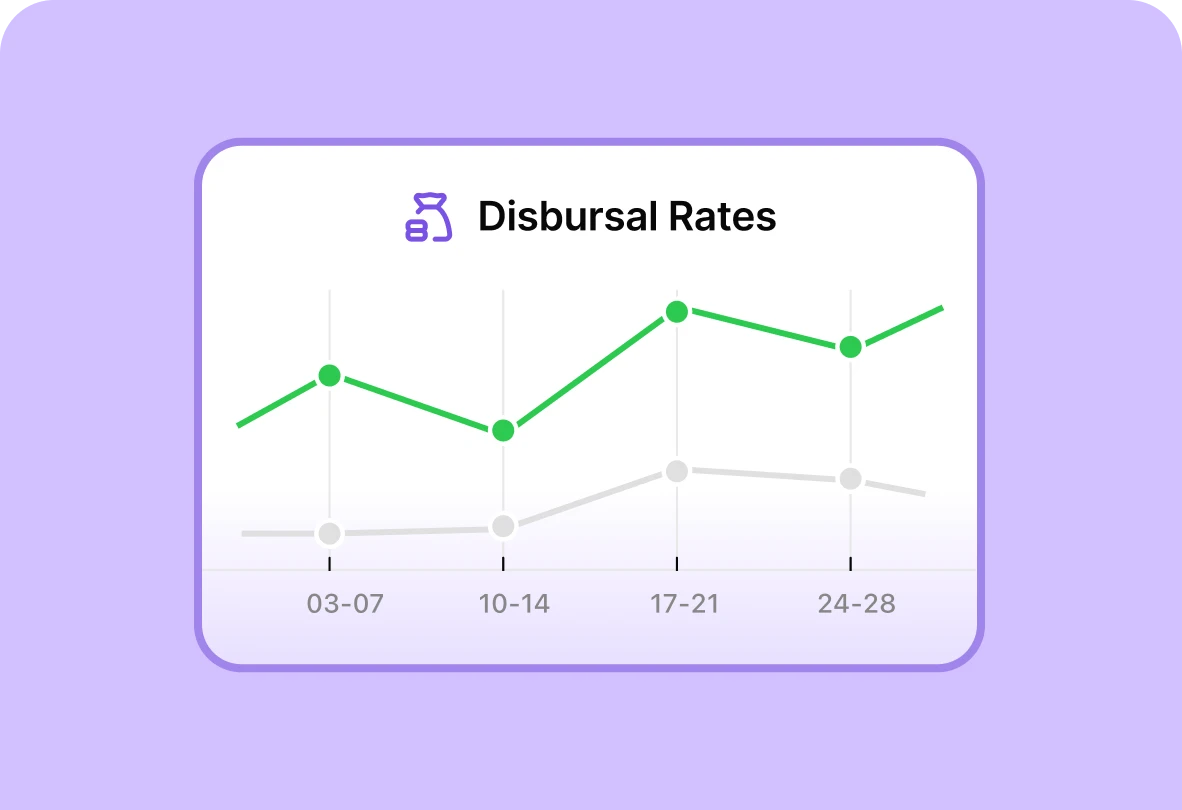

Faster Disbursals, Higher Efficiency

Standardized reporting and seamless data extraction - reducing time, resources & friction.

For Businesses

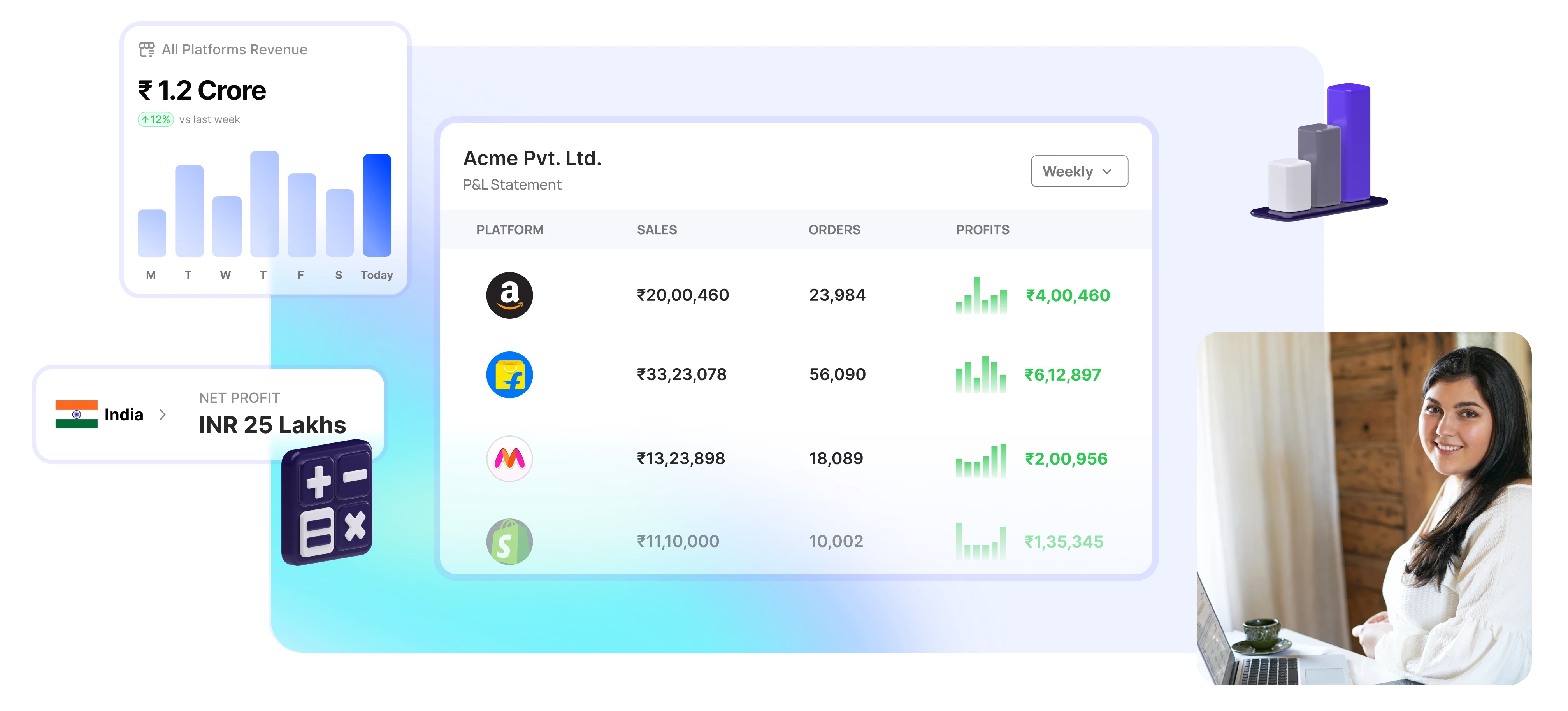

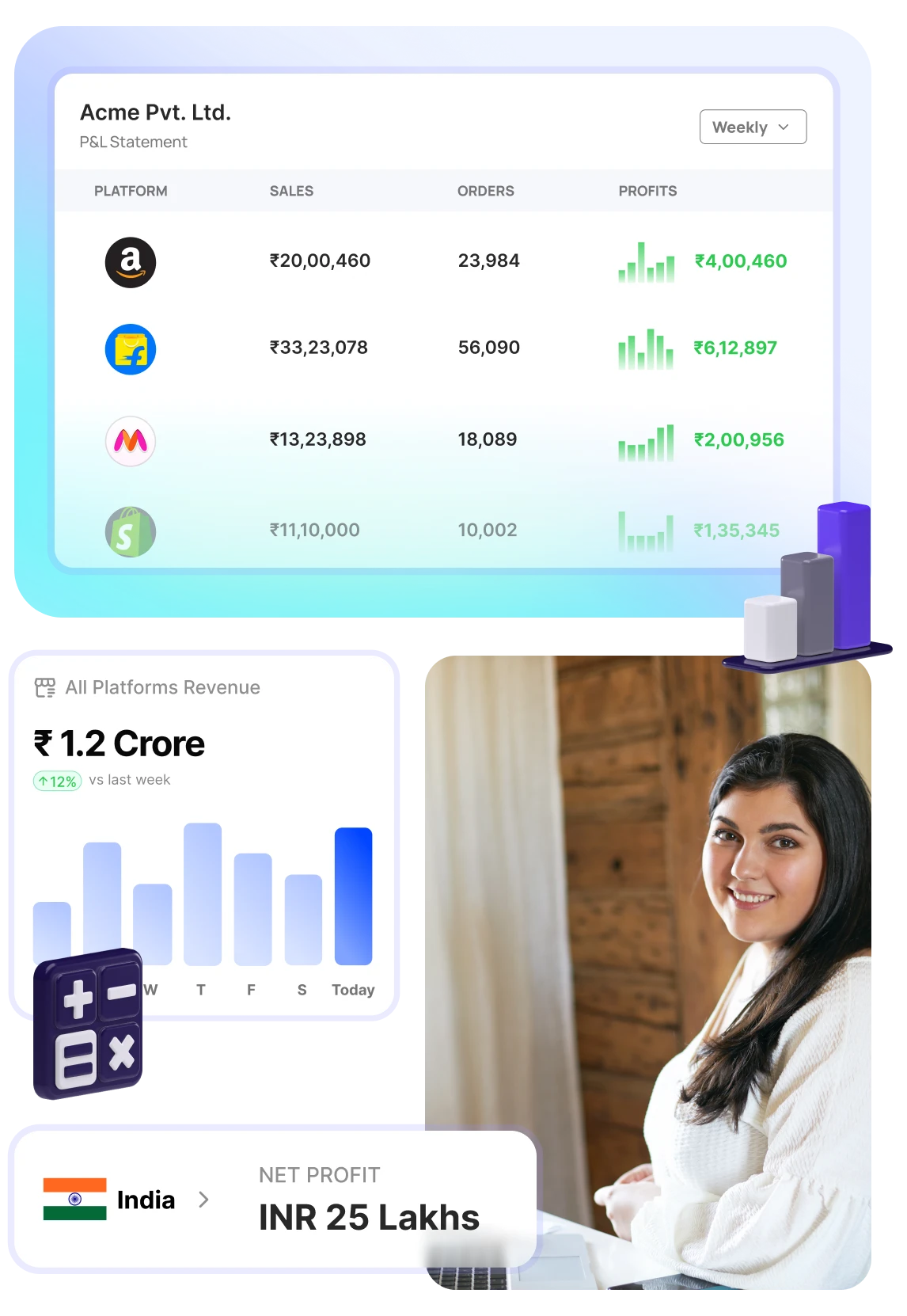

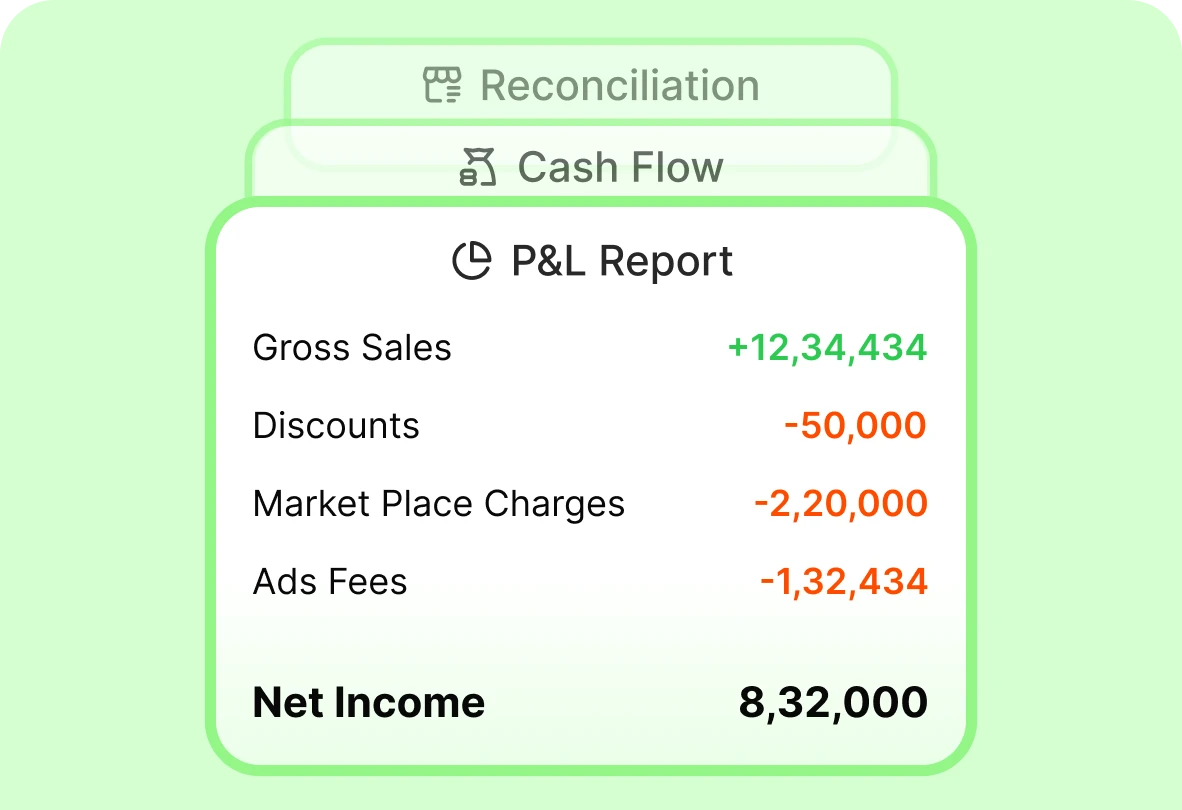

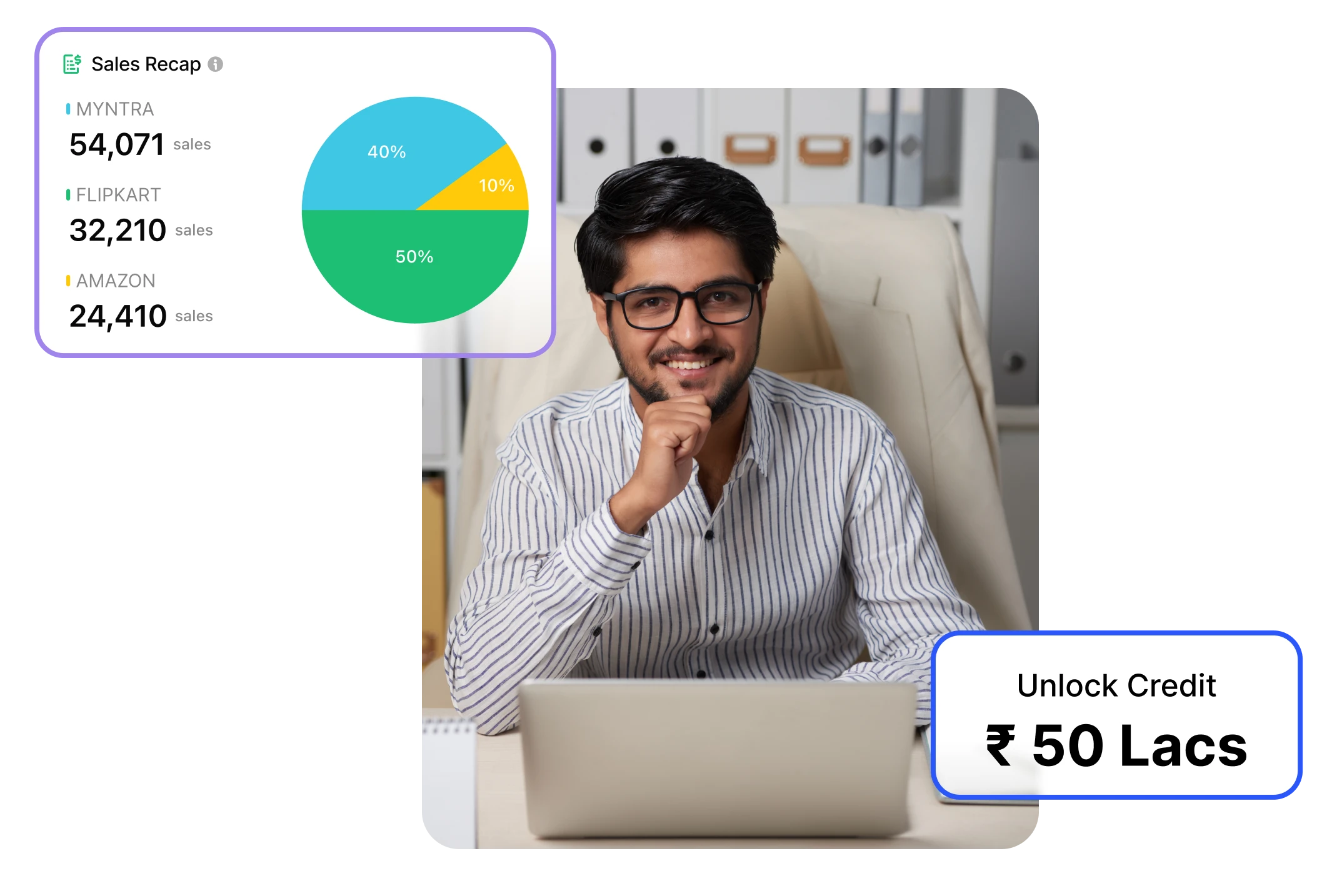

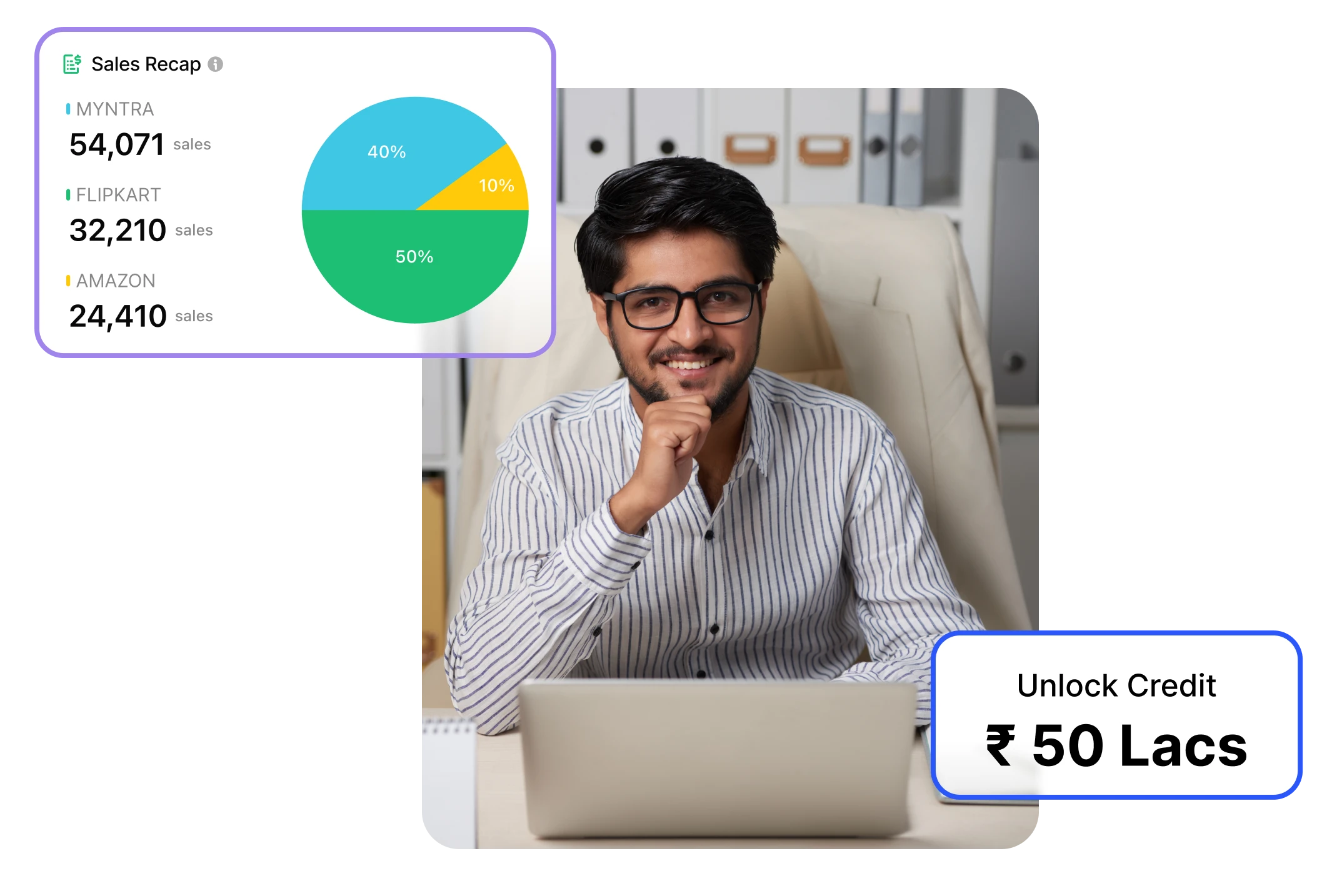

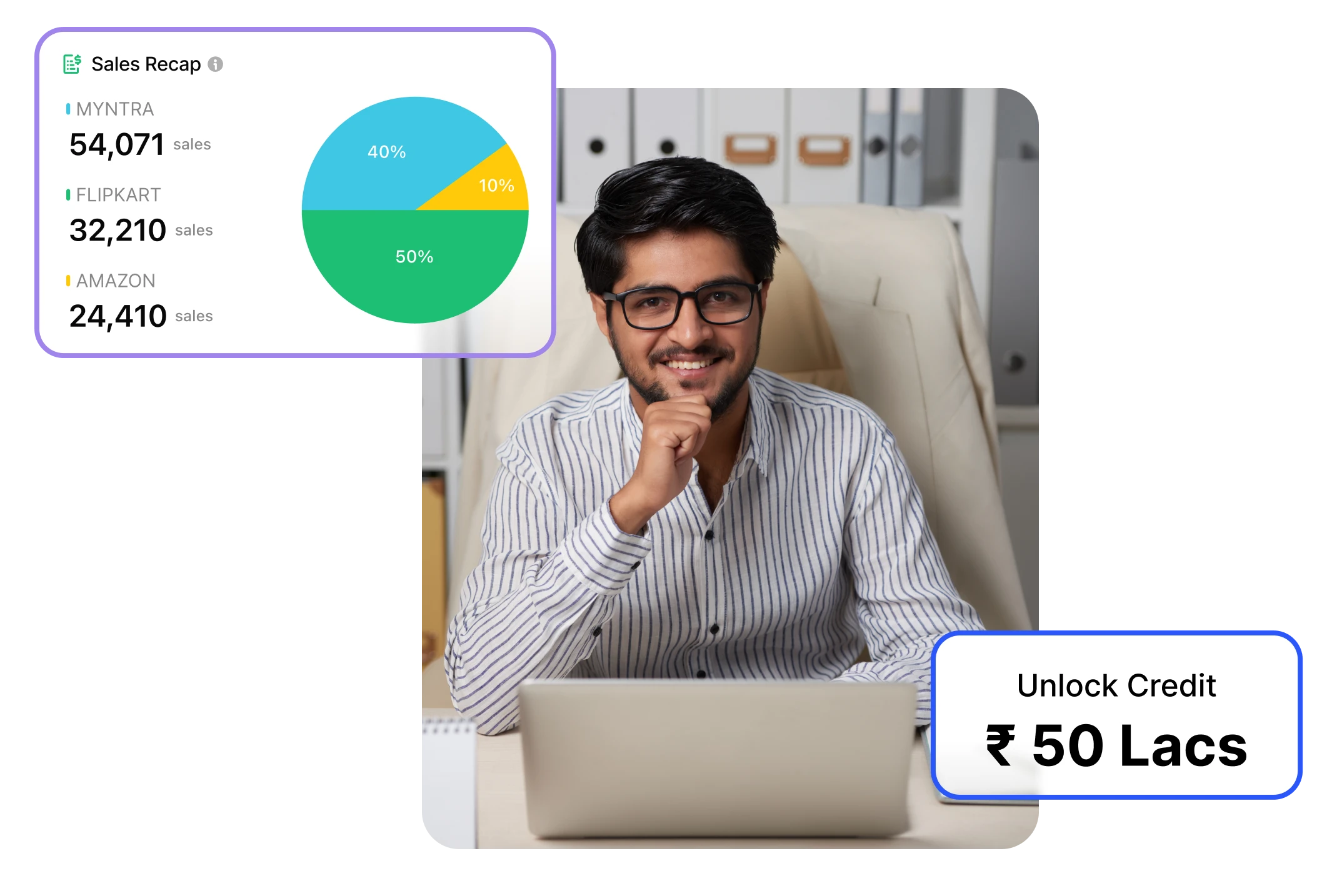

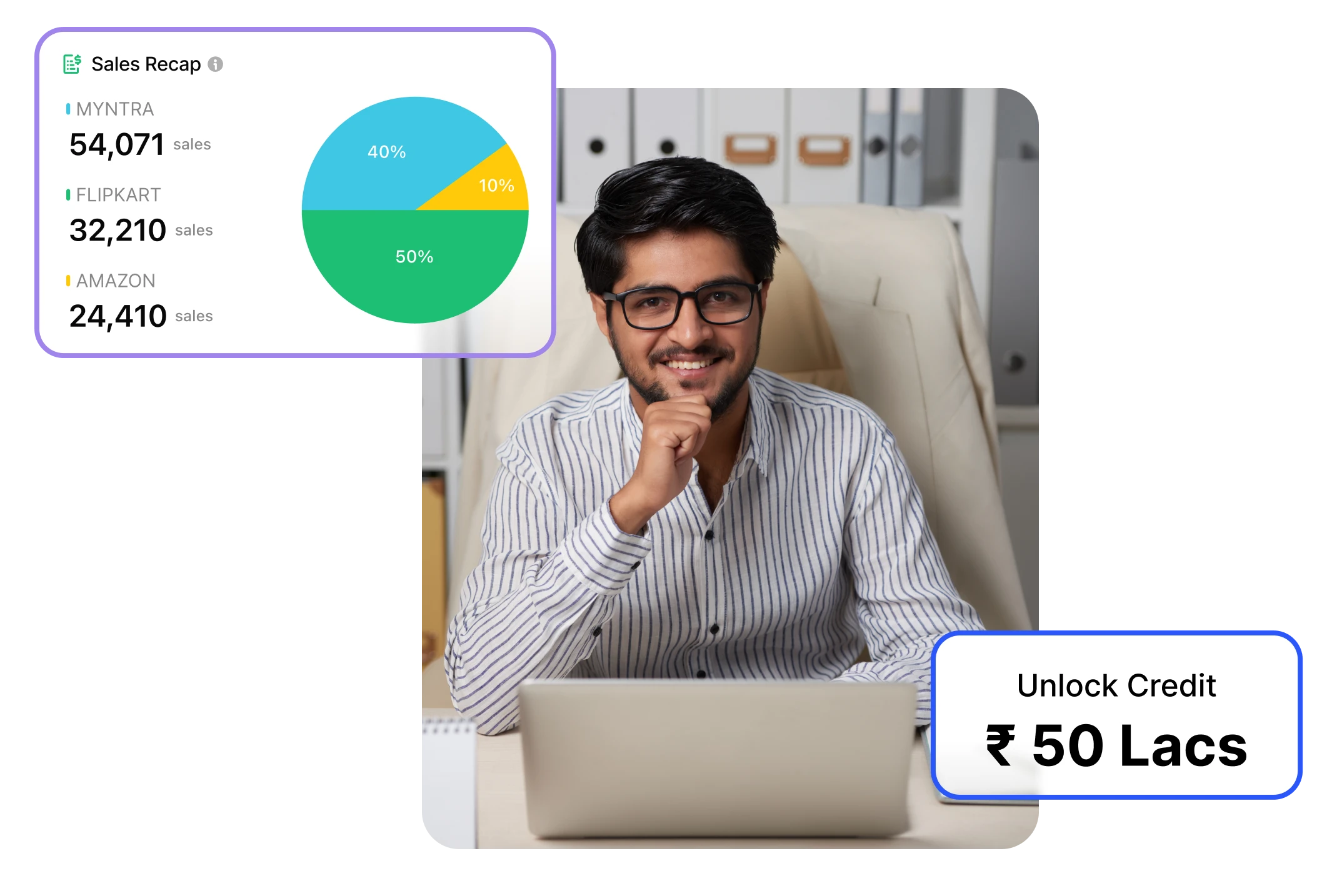

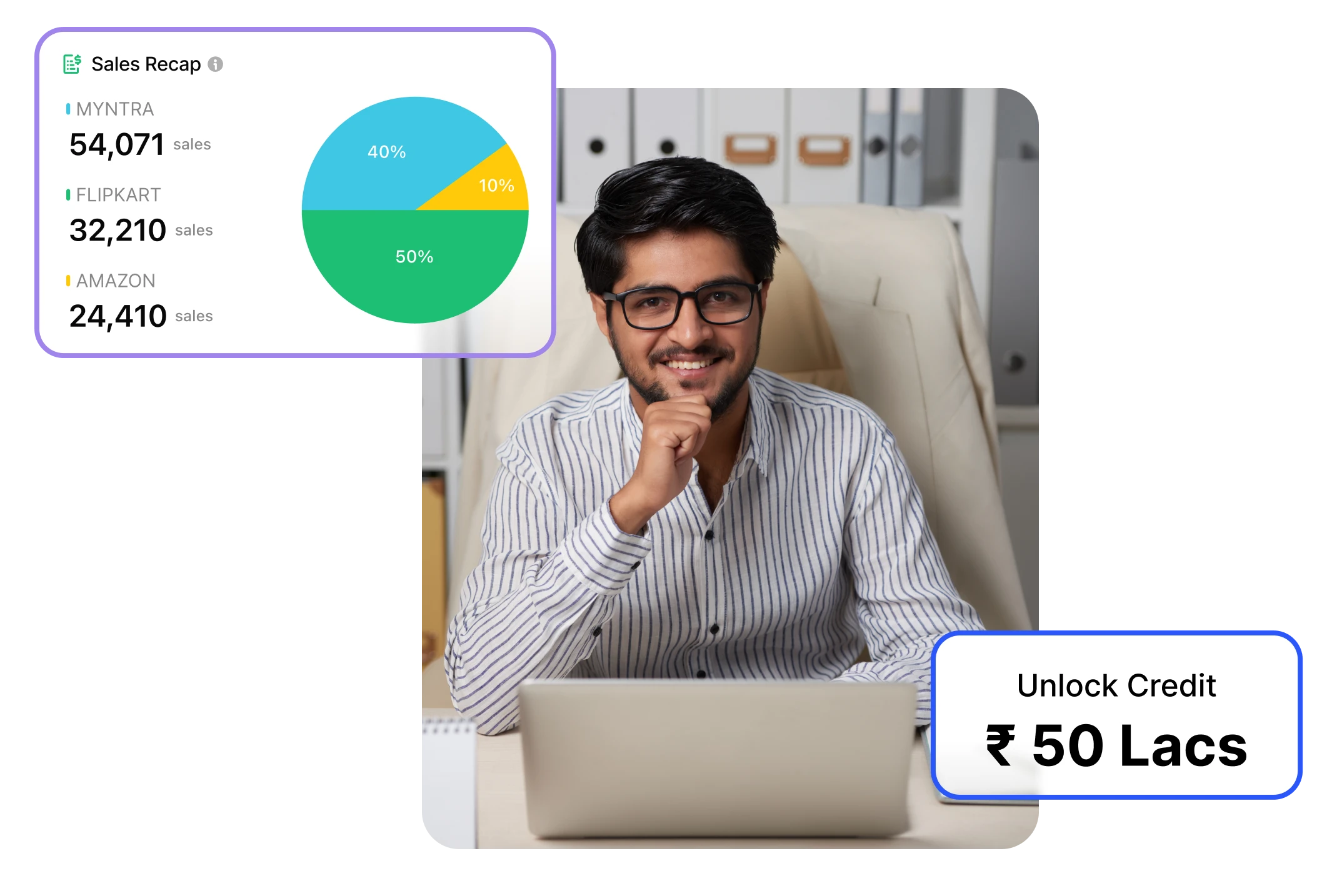

Know your numbers

Track cash flow, profits, and business performance—all in one place.

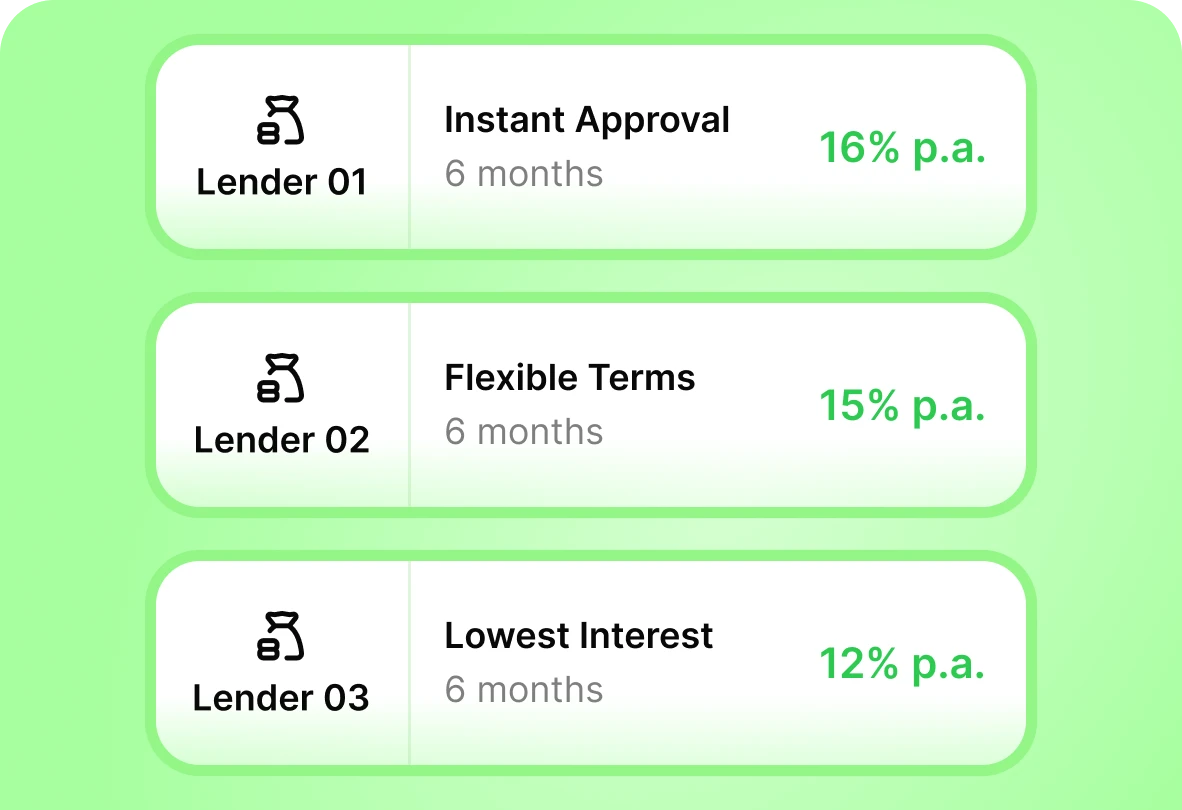

One Place, Multiple Credit Offers

Compare financing options from top lenders, instantly and easily.

Personalized solutions

Personalized advice based on your data to choose the right option for your business.

MoneyFlo has been an outstanding partner and an indispensable tool for me when seeking to understand the marketplace reconciliation cycle - return % - commission structures . It is the most essential tool I use as a seller to monitor the overall profitability of my business.

Japjeet Narang, Founder

Why choose Moneyflo

Why choose Moneyflo

MoneyFlo is a home to innovative finance technologies, & credit.

-

Transparent & Data-driven

-

Seamless integration with leading e-commerce platforms

-

Empowering small businesses with financial solutions

-

Free Financial Reporting, Track your Business Health

– 0 1 Million+

Monthly Transaction Volume

INR – 0 1 2 3 4 5 – 0 Cr+

Monthly GMV analyzed

– 0 1 2 – 0 1 2 3 4 x – 0 1 2 3 4 5 6 7

Access to Financial reports

Here is how the magic is done

01. Sign up on Moneyflo

02. Sync you data sources

03. Access reports and tailored credit options

MoneyFlo has been an outstanding partner and an indispensable tool for me when seeking to understand the marketplace reconciliation cycle - return % - commission structures . It is the most essential tool I use as a seller to monitor the overall profitability of my business.

Suhasini Sampath, Founder

Frequently asked questions

Have more questions?

- For Businesses

- For Lenders

Moneyflo is a platform that simplifies access to credit and provides in-depth financial insights for your business. We help you secure the best financial products by connecting you with lenders and providing you with insightful financial reports to make informed decisions.

Your data is securely encrypted and handled with the highest privacy standards. We do not share any information with any individual or organization without your permission.

We work with financial institutions to match you with credit options that suit your business needs. Our platform aggregates your financial data, making it easier for lenders to offer you personalized and transparent credit options.

Moneyflo provides financial insights and credit matching services at no upfront cost to you. We have separate paid plans if you have large volumes of data that you need reporting on. We charge lenders a fee if you successfully secure credit through our platform.

We have built connectors to sync data automatically across multiple channels without any efforts from your end. You just need to enter basic details, accept the terms, and we will handle the rest.

Moneyflo is a platform that connects you with SMBs seeking credit. We provide enriched financial data and insights, helping you make smarter underwriting decisions and reduce risk.

We aggregate a wide range of transactional data from SMBs, providing a comprehensive view of their financial health. This allows you to make more informed decisions and offer competitive credit options

You can access detailed financial reports, including cash flow analysis, profit margins, and transaction histories, all tailored to help you assess the creditworthiness of potential borrowers.

Becoming a partner is simple. Reach out to us through our contact form, and our team will guide you through the onboarding process, including integration and data access.

We prioritize data security with industry-standard encryption. All borrower data is handled with the utmost care and only shared with your institution under strict confidentiality agreements and with borrower consent.

Have more questions?